UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant |

| Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material |

JONES LANG LASALLE INCORPORATED

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| ||

| Payment of Filing Fee (Check | ||

| No fee required. | |

| Fee paid previously with preliminary materials. | |

| Fee computed on table | |

April 15, 201612, 2024

Dear Shareholder:Fellow Shareholders:

The2016You are invited to the 2024 Annual Meeting of Shareholders of Jones Lang LaSalle Incorporated(Jones Lang LaSalle, which may sometimes be referredis currently scheduled to asJLL, theCompany or aswe,us, orour) will take place onFriday, Wednesday, May 27, 2016,22, 2024, beginning at 1:8:00 p.m.a.m., local time, atCentral Time.

Our annual shareholders meeting will be conducted online in a virtual meeting format via live audio webcast. The accompanying 2024 Proxy Statement contains information about attending the JLL office located at2024 Annual Meeting online. You will not be able to attend the Aon Centre, 200 East Randolph Drive, 46th Floor, Chicago, Illinois 60601.2024 Annual Meeting physically in person.

At this year’s meeting, we will vote on theelection of ten directors and proposals detailed in theratification of the election of KPMG LLP as our independent registered public accounting firm. We will also conducta non-binding advisory vote to approve the compensation of the Company’s named executive officers. accompanying Proxy Statement.

There are three pending changes on the Board of Directors (theBoard) this year:Meeting attendance and voting

Your vote is very important to us. This year, we We genuinely hope you will join us online at our 2024 Annual Meeting of Shareholders. If you are again voluntarily furnishing proxy materialsnot able to our shareholders on the Internet rather than mailing printed copies to each shareholder. This serves our sustainability goals and also savesjoin us, significant postage, printing, and processing costs. Whether or not you plan to attend the Annual Meeting, please cast your vote as instructed in the Notice of Internet Availability of Proxy Materials, over the Internet, by telephone or by telephone,mail, as promptly as possible. You may also request a paper proxy card to submit your vote by mail if you prefer. If you attend the Annual Meeting, you may vote your shares in person even if you have previously given your proxy.

The mailing address of our principal executive office is JLL, Aon Centre, 200 East Randolph Drive, 46th Floor, Chicago, Illinois. We anticipate that we willexpect to mail the Notice of Internet Availability of Proxy Materials to our shareholders on or about April 15, 2016.12, 2024. The proxy materials we are furnishingfurnish on the Internet include our 20152024 Proxy Statement and our 2023 Annual Report, which includes our Annual Report on Form 10-K for the year ended December 31, 2015.2023.

WeChanges to our Board

On behalf of the Board and JLL, we would like to thank Ann Marie Petach for serving as a Director since 2015. Ms. Petach is not standing for re-election for another term. Her contributions as a Director, and particularly as the long-serving Chair of the Audit and Risk Committee, were invaluable to the Board and our company.

Finally, we welcome Susan Gore as a first-time nominee for Director this year. Ms. Gore is the former Managing Partner of PwC’s Global Technology and Information Security organization. Ms. Gore’s technology, information security and financial expertise as well as her significant prior experience in advising boards of directors and board committees make her an outstanding addition to the Board.

As always, we appreciate your continued interest in JLL.

Sincerely,

Chairman of the Board of Directors

Chief Executive Officer

| 1 |

AND PROXY STATEMENT

| When |  | Virtual Meeting |  | Record Date |

| Wednesday, May 22, 2024 8:00 a.m., Central Time | Via live audio webcast at www.virtualshareholder meeting.com/JLL2024 | Shareholders as of March 28, 2024 are entitled to vote |

Virtual meeting format The 2024 Annual Meeting will be conducted online through a live audio webcast. We believe a virtual meeting format facilitates stockholder attendance and enables stockholders to participate fully and equally from any location around the world, at no cost. The accompanying Proxy Statement contains information about attending the 2024 Annual Meeting online. You will not be able to attend the 2024 Annual Meeting physically in person.

|

Items of Businessbusiness

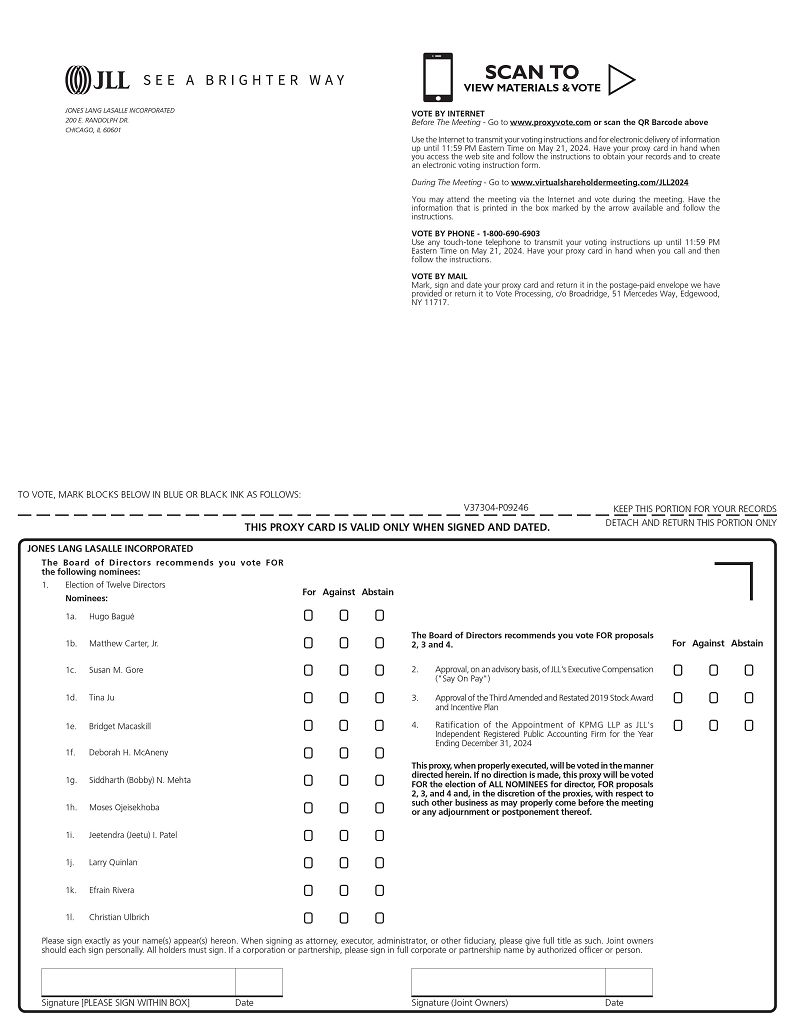

TheAt the 2024 Annual Meeting of Shareholders of Jones Lang LaSalle Incorporated (JLL or the Company), shareholders will havebe asked to vote on the following purposes:proposals:

| 1. | |

| 2. |

| 3. | Approval of the Third Amended and Restated 2019 Stock Award and Incentive Plan; and |

| 4. |

Record DateIn addition, we will transact any other business properly presented at the meeting, including any adjournment or postponement thereof, by or at the direction of the Board of Directors.

The BoardOther important information

You can vote if you were a shareholder of Directors has fixedrecord at the close of business onMonday, Thursday, March 14, 2016 as the record date for determining the shareholders entitled to receive notice of, and28, 2024, or if you hold a proxy from such a shareholder. If you are eligible to vote at the virtual 2024 Annual Meeting. WeMeeting you will permit only shareholders, or persons holding proxies from shareholders,be able to attend the meeting online, vote your shares electronically and submit questions during the meeting via live audio webcast. Shareholders of record may also view the list of registered holders entitled to vote at our 2024 Annual Meeting.Meeting on the virtual meeting website.

It is important that your shares be represented and voted at the 2024 Annual Meeting. You can vote your shares on the Internet, by telephone or by completing and returning your proxy or voting instruction card. Submitting your proxy by one of these methods will ensure your representation at the 2024 Annual Meeting regardless of whether you attend online. More information about attending the 2024 Annual Meeting online and voting before and at the meeting is provided on the next page. We will provide the Notice of Internet Availability of Proxy Materials, electronic delivery of the proxy materials or mailing of the 2024 Proxy Statement, the 2023 Annual Report on Form 10-K and a proxy card to shareholders beginning on or about April 12, 2024. By Order of the Board of Directors

Chief Legal Officer and Corporate Secretary April 12, 2024 Your Vote Matters: How to Vote

Attending the 2024 Annual Meeting WebcastYou are entitled to attend the virtual 2024 Annual Meeting online only if you were a shareholder of record at the close of business on Thursday, March 28, 2024—the Record Date—or you hold a valid proxy for the 2024 Annual Meeting. We encourage you to log into the website and access the 2024 Annual Meeting webcast early. Online access to the 2024 Annual Meeting webcast at www.virtualshareholdermeeting.com/JLL2024 will open at approximately 7:45 a.m., Central Time, on May 22, 2024. Shareholders of Record (shares are registered in your name)If you were a shareholder of record of JLL common stock at the close of business on the Record Date, you are eligible to attend the meeting, vote, change a prior vote, and submit questions. To access the meeting, visit www.virtualshareholdermeeting.com/JLL2024 and follow the prompts, which will ask you to enter your 16-digit control number. The control number is shown in a box on your proxy card or, if applicable, shown in the Notice of Internet Availability of Proxy Materials. Beneficial Shareholders (shares are held in the name of a bank, broker, or other institution)If you were a beneficial shareholder of JLL common stock as of the Record Date (i.e., you hold your shares through a broker or other intermediary), you may submit your voting instructions through your broker or other intermediary. To access the meeting, visit www.virtualshareholdermeeting.com/JLL2024 and use your 16-digit control number. You may vote your shares at the meeting or change a prior vote and submit questions. If you are a beneficial shareholder but do not have a control number, you may gain access to the meeting by contacting your broker or by following the instructions included with your proxy materials. Asking questionsIf you are a shareholder of record or a beneficial shareholder, you may submit questions in writing during the meeting through the meeting portal at www.virtualshareholdermeeting.com/JLL2024 using your 16-digit control number. We will attempt to answer as many questions as we can during the meeting. Similar questions on the same topic will be answered as a group. Questions related to individual shareholders will be answered separately by our shareholder relations team. Our replies to questions of general interest, including those we are unable to address during the meeting, will be published on our Investor Relations website after the meeting. Control numberYour 16-digit control number appears in a box on your proxy card, in our Notice of Internet Availability of Proxy Materials, or in the instructions that accompanied your proxy materials. If you do not have a 16-digit control number, you may gain access to the meeting by contacting your broker or by following the instructions included with your proxy materials. Technical supportIf you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the phone number displayed on the virtual meeting website on the meeting date.

Contents

About JLLOur organizational purposeWe shape the future of real estate for a better worldWho we areWe are a leading professional services firm that

What we do

2023 Business highlights

Human capitalThe cornerstone of JLL’s human capital strategy is helping our people to thrive in work and life through training and career advancement programs, competitive benefits, incentive offerings and well-being and health and safety programs.

Corporate sustainabilityWe partner with our stakeholders to drive impactful change by embedding sustainability into everything we do. JLL’s sustainability program delivers impact on climate action for sustainable real estate, healthy spaces for all people and inclusive places for thriving communities. JLL’s most recent ESG Report is available on the

Awards and recognition

• A member of the Bloomberg Gender-Equality Index, every year since 2020 • An Energy Star Sustained Excellence Award recipient, by the U.S. Environmental Protection Agency, for the twelfth consecutive year • One of the World’s Most Ethical Companies by the Ethisphere Institute, every year since 2008 • One of the World’s Most Admired Companies by Fortune Magazine, for the eighth consecutive year • To the Human Rights Campaign Foundation’s Corporate Equality Index, a benchmarking survey on corporate policies and practices related to LGBTQ workplace equality, for the ninth consecutive year • One of America’s Best Employers for Diversity by Forbes, every year since 2019 • One of the Best Places to Work for Disability Inclusion by the Disability Equality Index, for the fifth consecutive year • A member of Seramount’s Inclusion Index, recognizing our dedication and progress to creating an inclusive workplace for the second consecutive year • One of America’s 100 Most Sustainable Companies by Barron’s, for the fifth consecutive year • To the Wall Street Journal’s Management Top 250 ranking, for the fourth consecutive year • One of America’s Most JUST Companies by Forbes/JUST Capital for the second consecutive year • A Top Company for Executive Women by Seramount • One of U.S. News & World Report’s Best Companies to Work For

Proxy Statement Summary

Virtual meeting format

The 2024 Annual Meeting will be conducted online through a live audio webcast. We continue to

Shareholder voting matters and recommendationsThe following table summarizes the items that will be brought for a vote of our shareholders at the 2024 Annual Meeting, along with our voting recommendations.

Your Vote Matters: How to Vote

Our 2024 Director nominees

Our With these changes, our Board of Directors will continue to include 12 members, assuming all nominees are elected at the 2024 Annual Meeting. Proxies cannot be voted for a greater number of directors than the 12 nominees identified in this Proxy Statement. The following table and the charts below provide summary information about each of our Director nominees. You can find more information about each Director’s background and experience beginning on page 17.

Corporate governance highlightsJLL’s mission is to deliver exceptional strategic, fully-integrated services, best practices, and innovative solutions for real estate owners, occupiers, investors and developers worldwide. In order to achieve our mission, we Corporate governance policies and best practices

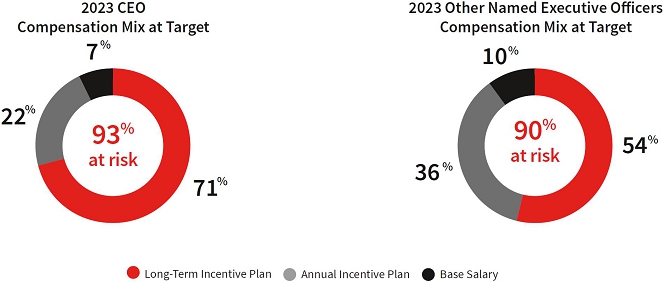

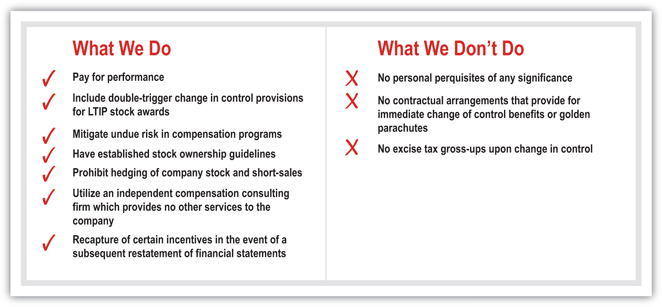

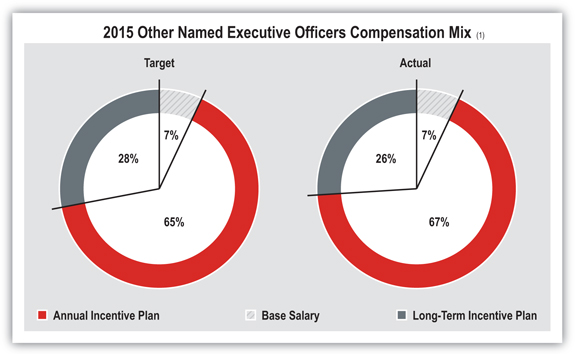

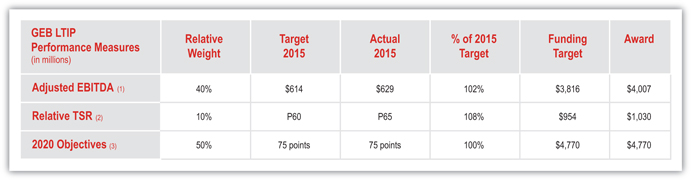

Components of our executive compensation programThe executive compensation program for our Global Executive Board (GEB) consists of a mix of fixed pay, short-term and long-term incentive compensation. We believe our compensation program enables us to attract and retain top-quality executives who are motivated to act in the best interests of our shareholders, clients, staff and other stakeholders. Our primary focus is on long-term incentive compensation to align with shareholder interests, and our annual incentive plan is designed as a supplement to drive business objectives in the near term.

This page intentionally left blank

Corporate Governance

Proposal 1 - Election of DirectorsOur Board is presenting 12 nominees for election as Directors at our 2024 Annual Meeting. Susan Gore is a first-time nominee as Director at the 2024 Annual Meeting. Ann Marie Petach, who is a current Director, is stepping down as a Director when her term ends at the 2024 Annual Meeting. Each Director elected will serve until the next annual meeting and until a successor is duly elected and qualified. Each nominee has consented to being named in this Proxy Statement and to serving as a Director, if elected. How we select DirectorsIdentifying and evaluating Director nominees The Nominating, Governance and Sustainability Committee employs a variety of methods to identify and evaluate Director nominees. Candidates may come to the attention of the Nominating, Governance and Sustainability Committee through Board members, JLL executives, shareholders, professional search firms or other sources. Ms. Gore was identified by Egon Zehnder, a leading independent director-recruitment firm, retained by the Nominating, Governance and Sustainability Committee to identify and help evaluate Director candidates who have extensive experience and qualifications in key strategic and priority areas. The Nominating, Governance and Sustainability Committee regularly assesses the size of the Board and determines whether any vacancies are expected due to departures. Director qualifications Our Board has adopted a Statement of Qualifications for Members of the Board of Directors to outline the characteristics we seek in Board nominees. We believe JLL Directors should have demonstrated notable or significant achievements in business, education or public service; they should possess the acumen, education and experience to make a significant contribution to the Board; and they should bring a range of skills, diverse perspectives and backgrounds to the Board’s deliberations. Our Board believes that having directors of diverse backgrounds helps the Board better oversee our management and operations and assess risk and opportunities from a variety of perspectives. Importantly, members of the Board must have the highest ethical standards, a strong sense of professionalism and a dedication to serving the interests of all JLL shareholders. The Statement of Qualifications groups these desirable characteristics in three categories, as shown below. Since 2022, the Statement of Qualifications has specifically included experience relating to environmental, social, legislative, regulatory and public policy matters and their impact on corporate governance.

To supplement the Statement of Qualifications, our Nominating, Governance and Sustainability Committee maintains an internal list of the more specific experiences and attributes that we want to have reflected on the Board. While we do not expect each Director to have all the desired experiences and attributes, we do seek to have them all represented on the Board as deeply as possible. When we are searching for a new Director, we strive to fill any relative gaps in the overall composition of the Board.

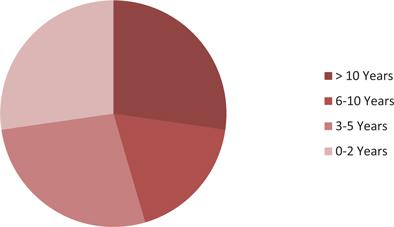

Summary of characteristicsThe following charts reflect various characteristics of our 2024 Director nominees. Our Directors’ ages, tenure and diversity of background are well-distributed to create a balanced Board populated by individuals with years of experience working with JLL and our industry and individuals who bring fresh perspectives. All of our non-employee Directors are independent.

Summary of Board nominee experience and skillsIn addition to the minimum qualifications that our Board believes are necessary for all Directors, the following chart highlights certain skills and experience that are relevant to our long-term strategy, and therefore relevant when considering candidates for election to our Board. A mark for an attribute indicates that the nominee gained the attribute through a current or prior position other than his or her service on the JLL Board. Our Board did not assign specific weights to any of these attributes or otherwise formally rate the level of a nominee’s attribute relative to the rating for any other potential nominee. The absence of a mark for an attribute does not necessarily mean that the nominee does not possess that attribute; it means only that when the Board considered that nominee in the overall context of the composition of our Board of Directors, that attribute was not a key factor in the determination to nominate that individual. Further information on each nominee’s qualifications and relevant experience is provided in the individual biographies that follow the chart.

Our 2024 Director nomineesA biography of each Director nominee, current as of March 28, 2024, appears below.

Professional, Leadership and Service Experience

Mr. Bagué is currently the Executive Director of Milvusmilvus Consulting GmbH, a consultancy company that he owns and runs, and has been on the Skills and Attributes Mr.

Professional, Leadership and Mr. Carter is the Chief Executive Officer of

Mr. Carter brings significant corporate leadership, brand management and technology experience to the JLL Board, drawing from his executive roles at several large companies. His service on other boards enhances our capabilities in Other Public Company Boards Current: NRG Energy, Inc., an integrated power company (since 2018).

Professional, Leadership and Service Experience

Skills and Attributes Ms. Gore brings a deep understanding of technology and security services to the JLL Board, as well as experience in executing digital transformation initiatives. Ms. Gore also brings significant expertise in finance, human capital, and operational planning, as well as considerable prior experience advising boards of directors and board committees, providing valuable insights and guidance on audit effectiveness and efficiencies.

Professional, Leadership and Service Experience Ms. Ju is a founding and managing partner of KPCB China and TDF Capital. She has more than 30 years of experience in venture capital, investment banking and operations. Ms. Ju began her venture capital career in 1999 and has led several noteworthy investments, including Alibaba, Baidu and Focus Media. She co-founded VTDF China in 2000 and KPCB China in 2007. Earlier in her career, Ms. Ju spent 10 years in investment banking including Deutsche Bank as the head of TMT and Transport Asia, Merrill Lynch as head of Asia Technology and Corporate Finance Team, and

Ms. Ju brings her extensive experience in venture capital, investment banking and operations to the JLL Board. Ms. Ju’s abilities to identify, engage and support some of China’s most accomplished entrepreneurs and successful enterprises are invaluable as we continue our focus on the future growth potential in Asia, and particularly China. Other Public Company Boards Current: Yiren Digital Ltd., a leading personal financial services platform in China, providing consumers with both credit and wealth management services (since 2015).

Professional, Leadership and Service Experience Ms. Macaskill currently serves as Chairman of Cambridge Associates LLC, a global investment firm. Until July 2019, she was the Non-Executive Chairman and, prior to that, the President and Chief Executive Officer, of First Eagle Holdings, Inc., a global investment firm, which she joined in 2009. Prior to joining First Eagle, Ms. Macaskill served as Chief Operating Officer, President, Chief Executive Officer and Chairman of Oppenheimer Funds, Inc., where she is recognized for creating the Oppenheimer Funds’ Women & Investing program, dedicated to educating American women about the need to take charge of their personal finances. Ms. Macaskill has served on a number of public company and not-for-profit boards. She served on the board of Close Brothers plc, a merchant banking firm, until November 2022, and on the board of Jupiter Fund Management plc until May 2020. Skills and Attributes Ms. Macaskill brings her experience in investment management, finance, accounting, shareholder relations, leadership, enterprise risk management, compliance and operations within a highly regulated industry to the JLL Board. Ms. Macaskill also brings experience in corporate social responsibility and diversity. Additionally, Ms. Macaskill brings perspectives on the British government and economy.

Professional, Leadership and Service Experience Ms. McAneny served in various roles at John Skills and Attributes Ms. McAneny brings her extensive board experience, senior management expertise and significant familiarity with our business and industry to the JLL Board, as well as particular knowledge of the Capital Markets business. Other Public Company Boards Current: KKR Real Estate Finance Trust, a real estate finance company (since 2017) and RREEF Property Trust, Inc., a non-traded REIT (since 2012). Prior within last five years: HFF, Inc. (2007–2019) and First Eagle Alternative Capital BDC, Inc. (f/k/a THL Credit Inc.) (2015-2023).

Professional, Leadership and Service Experience Mr. Mehta was the former President and Chief Executive Officer of TransUnion, a global provider of credit information and risk management solutions, from 2007 to 2012. From 1998 to 2007, Mr. Mehta held a variety of positions with HSBC Finance Corporation and HSBC North America Holdings, including Chief Executive Officer of HSBC North America Holdings and Chief Executive Officer of HSBC Finance Corporation. Prior to that, he was Senior Vice-President at The Boston Consulting Group and led their North American Financial Services Practice. Mr. Mehta also serves on several not-for-profit boards, including the Field Museum and the Chicago Public Education Fund. Skills and Attributes Mr. Mehta brings chief executive and senior management expertise in the financial services industry to the JLL Board, including in banking and the credit markets. He enhances our marketing, brand management, technology and strategic experience. Other Public Company Boards Current: The Allstate Corporation (since 2014) and Northern Trust Corporation (since 2019). Prior within last five years: TransUnion (2013-2021) and Piramal Enterprises Ltd., a global business conglomerate (2013-2020).

Professional, Leadership and Service Experience Mr. Ojeisekhoba has more than 20 years of senior leadership experience in the financial services industry. From July 2016 until April 2023, he served as the Chief Executive Officer Reinsurance for Swiss Re, where he was responsible for the company’s Reinsurance Business Unit, covering both property and casualty, as well as life and health, overseeing the company’s reinsurance strategy and operations in more than 20 countries and providing his knowledge and expertise to clients throughout the world. As of April 2023, Mr. Ojeisekhoba assumed leadership of Swiss Re’s newly formed Global Clients & Solutions Business Unit, which contains the client management teams servicing Swiss Re’s global reinsurance clients, Public Sector Solutions, iptiQ and Reinsurance Solutions. Mr. Ojeisekhoba serves as a member of Swiss Re’s Group Executive Committee. He is a frequent speaker on the topics of leadership, risk knowledge, digitalization, geopolitical trends and diversity. Mr. Ojeisekhoba holds a Bachelor of Science degree in Statistics from the University of Ibadan, Nigeria, and a master’s degree in Management from London Business School. Skills and Attributes Mr. Ojeisekhoba brings chief executive and senior management expertise in the financial services industry to the JLL Board, with a particular focus on client management, risk management and commercializing risk knowledge. His global client experience and perspective enhances our understanding of operational challenges in key markets throughout the world.

Professional, Leadership and Service Experience Mr. Patel is Executive Vice President & General Manager, Security and Collaboration, of Cisco Systems, Inc., where he joined in June 2020. From 2017 to 2020, he was the Chief Product Officer and Chief Strategy Officer at Box, Inc., a leading enterprise cloud content management platform. From 2015 to 2017, Mr. Patel was the Chief Strategy Officer and SVP of Platform at Box, Inc., where he led the creation of the Box Platform business unit, overseeing product strategy, marketing and developer relations. Before joining Box, Inc., from 2010 to 2015, Mr. Patel was General Manager and Chief Executive of the Syncplicity business unit of EMC Corporation, a developer and seller of data storage and data management hardware and software. Skills and Attributes Mr. Patel brings chief executive and senior management expertise, together with product and engineering management skills, marketing, brand management, strategic and strong technology experience to the JLL Board. Moreover, he brings decades of expertise accelerating fast-growing, established and start up business models in highly competitive markets. Other Public Company Boards Current: Equinix, a digital infrastructure company (since 2022).

Professional, Leadership and Service Experience Mr. Quinlan was the Global Chief Information Officer of Deloitte, LLP, a professional services firm, where he was responsible for all facets of Deloitte’s technology strategy and operations and oversaw more than 10,000 IT professionals in 175 countries. Mr. Quinlan spent 33 years at Deloitte (1988-2021), where he led Deloitte’s global implementations of ERP & CRM systems, including some of the world’s largest SAP and Salesforce platforms leveraging data analytics, cloud hosting and collaboration technologies from AWS, Microsoft, Google, Oracle and ServiceNow. In addition to his CIO role (2010-2021), Mr. Quinlan drove significant revenue leading Deloitte services to Fortune 500 global clients in the hospitality and technology sectors and advised company boards and CEOs on a wide range of IT, cybersecurity and digital strategic priorities. Mr. Quinlan serves on the non-profit boards of the United Way of Miami and the Adrienne Arsht Performing Arts Center. He also is passionate about improving opportunities in underserved communities. Together with other CIOs, Mr. Quinlan founded The TechPACT, an organization committed to bridging the digital divide. Skills and Attributes Mr. Quinlan brings deep expertise across every facet of the digital and technology transformation journey to the JLL Board. Mr. Quinlan’s extensive leadership experience in digital and technology strategy and operations, and cybersecurity, are invaluable as we continue to grow our technology focused JLL Technologies business and support our clients’ technological business needs. Other Public Company Boards Current: Current: ServiceNow (NYSE:NOW), a leading cloud digital workflow company (since 2021), and Booking Holdings (NASDAQ:BKNG), a leading provider of online travel and related services (since 2022).

Professional, Leadership and Service Experience Mr. Rivera is currently Senior Advisor to the Chief Executive Officer of Paychex, Inc., a leading provider of integrated human capital management solutions. Previously, Mr. Rivera held the position of Senior Vice President and Chief Financial Officer of Paychex, Inc. Prior to that, Mr. Rivera worked for Bausch & Lomb, a global eye health company, where he held senior management positions, including Chief Financial Officer. Mr. Rivera has also served in higher education administration and in the Civil Division of the U.S. Department of Justice. Mr. Rivera is a Certified Management Accountant (CMA) and Certified in Financial Management (CFM). Skills and Attributes Mr. Rivera brings significant global experience in finance and operations to the JLL Board, drawing from his executive roles at large multinational companies. His prior finance and management experience enhances our

Professional, Leadership and Service Experience Mr. Ulbrich has been the Chief Executive Officer (CEO) and President of JLL since October 2016. He is also the Chairman of our

Skills and Attributes

Shareholder recommendations

Any shareholder recommendations for individuals to be considered as potential nominees must be in writing and should include the candidate’s name, age, business address, principal occupation and qualifications for Board membership, as well as evidence the proposed nominee consents to serve as a Director if elected.

Proxy access

Our

Majority voting

In an uncontested election (where the number of board seats equals the In the event an incumbent Director fails to receive a majority of the votes cast in an uncontested election, such Director must promptly tender a resignation to the Board. The Nominating, Governance and Sustainability Committee (or another committee designated by the Board) must make a recommendation to the Board whether to accept or reject such resignation, or whether other action should be taken. The Board must act on the resignation, taking into account the Nominating, Governance and Sustainability Committee’s recommendation, and publicly disclose its decision (and, if such resignation is If an incumbent Director’s resignation is accepted by the Board, or if a non-incumbent nominee for Director is not elected, then the Board, in its sole discretion, may fill any resulting vacancy or may decrease the size of the Board. Corporate governance principles and Board mattersKey governance documents and policies

We maintain a corporate governance section on the Investor Relations page of our

We will make any of this information available in print to any shareholder who requests it

The Board

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| |

Information about the Board of Directors and Corporate Governance

The Board, whose members ourelected by the Company’s shareholders, elect annually, is theultimate decision-making bodyresponsible for management of the Company except with respect to those mattersCompany’s business and for decisions it has reserved to the shareholders either byfor itself or that applicable law our Articles of Incorporation or our By-Laws.requires it to make. The Board elects each of the Chairman of the Board and the Chief Executive OfficerCEO and certain other members of the senior management team. Senior managementteam, which is responsible forcharged with conducting JLL’sthe Company’s business under the oversight of the Board to enhance the long-term value and sustainability of the Company forto the benefit of its shareholders. The Board acts as an advisor and counselor to JLL’sthe CEO and the Company’s senior management and ultimately monitors the establishmentCompany’s performance. The best commonly held practices and the realities of itsbusiness dictate that governance over many of the complex decisions required to operate the Company shall be made by, or upon consultation and deliberation with, those separate Committees of the Board, executive and management committees, or individual executives best equipped to make them because of their relative expertise and business focus. The Board ultimately may override the CEO and management on any matter, including, but not limited to, matters relating to the Company’s management of enterprise risks.

The executive officers of the Company (see page 38) effect their decision-making process and execute their business decisions in ways that reflect a high level of communication, coordination, transparency and deliberation among those whose experience, knowledge, judgment and executive abilities are most likely to contribute to the best possible outcomes. To that end, the Company has enacted a Delegation and Exercise of Corporate Authority Policy (Corporate Authority Policy), issued by the Board, that establishes the respective levels of corporate strategyauthority required, and its performance relativethe informational and deliberative process generally to be followed, for any officer or employee of the Company to commit resources or incur liabilities on behalf of the Company.

As set forth in our Bylaws, the Company’s CEO reports to the Board and is responsible for the overall strategies of the business. The CEO coordinates and manages the efforts of the Company’s senior executives to develop and achieve the Company’s current and long-term objectives and vision. The CEO is responsible for the Company’s operating policies and procedures and serves as the Company’s senior management representative to its strategic goals.clients, the financial community and the general public. In order to exercise his or her corporate authority with respect to significant matters having implications beyond one business segment or for the Company as a whole, the Corporate Authority Policy contemplates that the Company’s CEO shall be assisted by the GEB.

The Board is responsible for the succession plan for the Company’s CEO. To assist the Board, the CEO annually presents to the Board on succession planning for all senior officers of the Company with an assessment of senior managers and their potential to succeed the CEO and other senior management positions. The CEO also prepares, on a continuing basis, a short-term succession plan which delineates a temporary delegation of authority to certain officers of the Company if all or certain of the senior officers should unexpectedly become unable to perform their duties. The short-term succession plan will be in effect until the Board has the opportunity to consider the situation and take action, when necessary.

A

The principal responsibilities of the GEB, are to determine, and direct the execution of, the Company’s overall business strategy, under the oversight and direction of the CEO and the Board. The GEB is responsible for assisting the CEO in:

| • | Determining the overall business strategy and annual business plans and budget of the Company; |

| • | Monitoring, evaluating and evolving the Company’s strategy, plans and budget on a continuous and flexible basis over time as business, economic, geo-political and other relevant opportunities and factors dictate; |

| • | Directing the execution of the overall business strategy and plan in the most efficient, coordinated and effective manner possible; |

| • | Deciding upon and giving the approvals with respect to particular matters as contemplated by the Corporate Authority Policy; and |

| • | Serving as a readily identifiable and accessible forum within which the leaders of the Company’s respective business may: |

| – | Debate and establish the Company’s business strategies and execution tactics having multi-jurisdictional or global implications; | |

| – | Raise strategic or execution issues having Company-wide implications; | |

| – | Share best practices and lessons learned that have potentially multi-jurisdictional, multi-business segment or global implications; | |

| – | Inquire about resources and business practices that may be transferable from one part of the Company to another; and | |

| – | Generally serve as a valuable resource for each other in the conduct of the Company’s business. |

| 2024 Proxy Statement | 25 |

The Nominating, Governance, and Sustainability Committee has responsibility to assist the Board in overseeing the Company’s policies, programs and related risks to the Company that concern certain environmental, social, legislative, regulatory and public policy matters (ESG). The Nominating, Governance and Sustainability Committee is also assigned the following responsibilities:

| • | Review and discuss, and bring to the attention of the Board current and emerging ESG and sustainability policy trends that could impact JLL’s business operations, performance, and reputation; |

| • | Review and discuss JLL’s implementation of procedures for identifying, assessing, monitoring and managing ESG and sustainability risks related to JLL’s business; |

| • | Review and discuss JLL’s integration of ESG and sustainability policies, practices and goals into its business strategy and decision-making; |

| • | Review JLL’s sustainability program and goals and JLL’s progress toward achieving those goals; and |

| • | Review in advance and discuss JLL’s voluntary ESG and sustainability reporting. |

Our Corporate Governance Guidelines provide that a majority of our Board consists of independent Directors. All of the members of the Audit, Compensation, and Nominating and Governance Committees of our Board are independent Directors. must be independent. For a Director to be considered independent, the Board must determine that the Director does not have any direct or indirect material relationship with JLL and meets all the Company. The Board observes all criteria for independence and experience established by the New York Stock Exchange (NYSE (including Rule 303A in its Listed Company Manual) and by other governing laws and regulations.

). The Board has determined that Hugo Bagué, Samuel A. Di Piazza, Jr., Dame DeAnne Julius, Ming Lu, Martin H. Nesbitt, Sheila A. Penrose, Ann Marie Petach, Shailesh Rao, and David B. Rickard, all of whomour Directors are currentindependent except Mr. Ulbrich, our CEO. All the members of our Board,the Board’s three standing committees are independent according towithin the criteria we describe above. These are the Directors we describe in this Proxy Statement as being Non-Executive Directors (meaning Directors we do not otherwise employ as Corporate Officers).meaning of applicable SEC regulations and NYSE listing standard.

In connection with the independence determinations for Hugo Bagué, Samuel A. Di Piazza, Jr., Ming Lu, Martin H. Nesbitt, Sheila Penrose, Ann Marie Petach and Shailesh Rao,each of our non-employee Directors, the Board considered transactions and relationships between each Director, or any member of his or her immediate family, and JLL and its subsidiaries and affiliates. The Board also considered whether there were any transactions or relationships between JLL and a Director, or any member of his or her immediate family (or any entity in which a Director or any immediate family member is an executive officer, general partner, or significant equity holder). Ultimately, the Company with entities with which such Directors are orBoard concluded that the transactions considered were associated, as current or former directors, officers, employees, partners and/or equity-holders, notingroutine and normal, and that each such transaction consists of services being provided byno Director derived a material benefit from the Company in the ordinary course of business, with customary consideration being received by the Company in exchange therefor (and no consideration being received directly or indirectly by the Director).transactions. None of these transactions was considered a material relationship that impacted the applicablea Director’s independence.

Given In particular, in determining that affiliatesMs. Petach is independent, the Board considered her service as director of certain companies affiliated with BlackRock, Inc. in the aggregate, which companies collectively constitute a significant shareholder of JLL, which may from time to time include certain of the affiliates whereJLL. The Board determined that these relationships do not compromise Ms. Petach remains a member of the board of directors,Petach’s independence. Further, we have also putimplemented procedures, in place, to which BlackRock has agreed, to avoid conflicts of interest with respect to information regarding JLL.

Our leadership structure separates our CEO and Chairman of the Board positions. Barring exceptional circumstances, such as the CEO unexpectedly becomes unable to perform his or her duties, we do not intend for the CEO and Chairman of the Board positions to be held by the same individual. We believe this approach is useful and appropriate for a complex and global organization such as ours, as it provides independent Board leadership and engagement while allowing our CEO to focus on his primary responsibility for managing the operational functions of JLL, ensuring a seamless and refined execution of strategic initiatives. The Board is responsible for succession planning for the Chairman of the Board position including a short-term succession plan in the event that the Chairman of the Board should unexpectedly become unable to perform his duties. The Board-approved succession plan will be in effect until the Board elects a successor Chairman of the Board pursuant to the Bylaws.

Mr. Mehta, a non-employee Director, has served in the Chairman role since July 2020.

The duties of the Chairman of the Board include the following:

| • | Chair Board meetings and encourage constructive engagement and open communications; |

| • | Preside over regularly-scheduled executive sessions of our non-employee Directors including an executive session during which the CEO’s performance is formally evaluated on an annual basis; |

| • | Coordinate the activities of, and facilitate communications among, our non-employee Directors; |

| • | Chair our annual shareholders’ meetings; |

| • | Establish each Board meeting agenda, consulting with the CEO and the Chief Legal Officer, and ensure that the agenda and materials are complete and timely and address the key priorities; |

| • | Represent JLL with clients and shareholders as required; |

| • | Act as a mentor and confidant to the CEO in support of his successful performance, attend internal company meetings as required, and encourage direct communications between the CEO and individual members of the Board; |

| • | Together with the Nominating, Governance and Sustainability Committee, regularly review and provide input on the structure of the Board and the Board Committees as part of the annual Board and Committee evaluation process; and |

| • | Maintain regular and open dialogue with Board members between meetings. |

The Board has determined that each person who serves as Chairman of the Board, if that person is independent, will automatically also serve as a member of each of the Board’s committees.

| 2024 Proxy Statement | 26 |

The full Board held seven meetings during 2023, four of which were held by videoconference. Each Director attended, in aggregate, at least 88% of all meetings of the Board and of any committee on which such Director served during the periods in which such Director served. Our non-employee Directors frequently meet in executive session without management participation, either before or after Board meetings. The Chairman of the Board presides over these executive sessions. In 2023, the Board met in executive session on six occasions, with the Audit and Risk Committee and the Compensation Committee meeting in executive session six and seven times, respectively.

We strongly encourage all Board members to attend the annual meeting of shareholders each year. All of our Directors on the Board were present at our 2023 Annual Meeting of Shareholders.

The Board has established the Audit and Risk, Nominating, Governance and Sustainability, and Compensation Committees to assist it in discharging its responsibilities. The members and number of meetings for each of these committees in 2023 and their primary responsibilities are listed below. A complete list of the responsibilities of each committee can be found in the committee charters, which are available in the corporate governance section on the Investor Relations page of our website at www.ir.jll.com.

| All members of the Audit and Risk, Nominating, Governance and Sustainability, and Compensation Committees are non-employee Directors who are independent under NYSE listing standards, JLL’s Corporate Governance Guidelines, and applicable rules under the Securities Exchange Act of 1934 Act (the 1934 Act). |

Audit and Risk Committee  | ||

| Members* | The Audit and Risk Committee acts on behalf of the Board to monitor | |

Larry Quinlan (Chair) Tina Ju Siddharth (Bobby) Mehta Jeetendra (Jeetu) I. Patel Ann Marie Petach Efrain Rivera Number of meetings in 2023: 8 100% attendance by all members *Ann Marie Petach was Chair of the Audit and Risk Committee through November 2023; Bridget Macaskill was a member of the Audit and Risk Committee through May 2023 | • the integrity of JLL’s financial statements; • the qualification, independence and performance of JLL’s independent registered public accounting firm; • the performance of our internal audit function; • JLL’s enterprise risk management framework; and • JLL’s cybersecurity and information technology readiness. See also the “Audit and Risk Committee Report” on page 85. Our Board has determined that each member of our Audit and Risk Committee is “financially literate” as required by the NYSE. Our Board has also determined that Ms. Petach is an “audit committee financial expert” as defined by SEC rule. | |

| 2024 Proxy Statement | 27 |

Compensation Committee  | ||

| Members* | The Compensation Committee acts on behalf of the Board to | |

Deborah H. McAneny (Chair) Hugo Bagué Matthew Carter, Jr. Bridget Macaskill Siddharth (Bobby) Mehta Moses Ojeisekhoba Number of meetings in 2023: 7 100% attendance by all members *Bridget Macaskill was a member of the Compensation Committee beginning in June 2023 | • formulate, evaluate and approve the compensation of JLL’s GEB; • oversee all compensation programs involving the use of JLL common stock; and • approve performance goals for our GEB incentive compensation programs and review the extent to which those performance goals have been achieved at the end of each performance period. See also the “Compensation Committee Report” on page 56. The Board has determined that all Compensation Committee members are independent within the meaning of NYSE rules, including the heightened independence criteria for Compensation Committee members. All are “non-employee” directors under SEC rules and outside directors under the Internal Revenue Code. Compensation Committee interlocks and insider participation There are no Compensation Committee interlocks, and there is no insider participation on the Compensation Committee. Certain executive leaders attend meetings of the Compensation Committee in order to present information and answer questions. | |

| 2024 Proxy Statement | 28 |

Nominating, Governance and Sustainability Committee

| Members | The Nominating, Governance and Sustainability Committee acts on behalf of the Board to | |

As a policy matter, all of our non-employee Directors are automatically members of this committee. Mr. Carter serves as Chair. Number of meetings in 2023: 4 100% attendance by all members | • identify and recommend qualified candidates to be Director nominees and to fill vacancies on the Board occurring between annual meetings; • recommend Directors to serve on each Board committee; • develop and recommend the Corporate Governance Guidelines; • oversee JLL’s policies and programs and related risks to JLL that concern certain environmental, social, legislative, regulatory and public policy matters; and • lead the annual review of the Board’s performance. |

The term of Ann Marie Petach is expiring at the 2024 Annual Meeting, and she is not standing for reelection. Accordingly, Ms. Petach will cease to serve on the above-mentioned committees upon the expiration of her term at the 2024 Annual Meeting. We expect Ms. Gore will replace Ms. Petach on both the Audit and Risk Committee and the Nominating, Governance and Sustainability Committee.

We provide new Directors with an initial orientation about JLL, including our business operations, strategy, Code of Ethics and policies, including those with regard to sustainability, integrated reporting, tax, audit, financial reporting, talent, reward and governance.

All of our Directors have access to resources and ongoing educational opportunities to help them stay current about developments in corporate governance and critical issues relating to the operation of public company boards and their committees.

We actively participate in various professional organizations that provide training opportunities and information about best practices in corporate governance and business ethics.

Our Directors also visit company offices in different cities as part of regularly scheduled Board meetings. These visits typically include sessions with management, staff and clients. In 2023, our Board held in-person meetings at our offices in Chicago and San Francisco.

Our Board annually conducts a process, including a self-assessment, to determine whether it and its committees are functioning effectively and how they might enhance their effectiveness. Our Board evaluation process alternates each year.

| 1. | Information gathered • (Odd Years) An independent consultant conducts a one-on-one assessment with each director in January and February regarding Board and committee effectiveness and engagement. • (Even Years including 2024) Each Director completes a written self-assessment questionnaire on an anonymous basis in January regarding Board and committee effectiveness and engagement. |

| 2. | Compilation and initial review of information • (Odd Years) The independent consultant or internal legal personnel, as applicable, compiles information from these individual assessments without individual attribution. • (Even Years including 2024) The Chair of the Nominating, Governance and Sustainability Committee reviews the anonymized information from the individual assessments, including with the independent consultant, as applicable. |

| 3. | Committee and full Board sessions • The independent consultant or Chair of the Nominating, Governance and Sustainability Committee, as applicable, leads a discussion with the full Board at its March meeting regarding the assessments provided by the Board members. • The Board continues the discussion around Board and committee effectiveness and engagement in non-management executive sessions. • As needed, individual Board committees discuss assessments provided. |

| 2024 Proxy Statement | 29 |

Successful management of our enterprise risks is critical to JLL’s long-term sustainability. Management is responsible for identifying and mitigating JLL’s enterprise risks, but the Board and its committees take active roles in overseeing that effort. In particular, the Board focuses on substantive aspects of management’s evaluation of enterprise risks and the efforts management is making to avoid and mitigate them. The Company has adopted a combined assurance model to align assurance programs between enterprise risk management, compliance and ethics, internal audit and other assurance providers within the Company, to deliver deeper insights to the Board and management on governance, risk management, and effective control design and execution. The purpose of the combined assurance model is to deliver effective risk oversight by assisting the Board and management in protecting the Company through risk aggregation, adoption of proven practices, reduction of duplicative efforts with assurance activities, and providing a common methodology to evaluate and manage risks.

The Audit and Risk Committee focuses on the process management follows to continuously identify enterprise risks and monitors the mitigation efforts management has established. The Audit and Risk Committee semi-annually discusses with the Company’s global director of enterprise risk management and senior management the process that has been followed to establish an enterprise risk management report. The global director of enterprise risk management, who reports into the Company’s Chief Legal Officer, provides a risk environment update that evaluates risk both on potential impact to the Company and also based on the time frame when the risk is likely to have an impact. The global director of enterprise risk management performs a horizon scanning with the assistance of outside advisors and experts to anticipate future threats to the Company and emerging trends. In preparing the risk environment update report, the global director of enterprise risk management meets with the GEB and other senior management to gather input which is then aggregated and used in preparing the proposed top risks for the Company. This report, which is reviewed by our Audit and Risk Committee, reflects the then-current most significant enterprise risks that management believes JLL faces, the efforts management is making to avoid or mitigate the identified risks, and how our internal audit function proposes to align its activities to mitigate the identified enterprise risks. The risks identified in the enterprise risk management report are reviewed by management in connection with the Company’s disclosure controls and procedures.

The Compensation Committee monitors and discusses with management those risks that are inherent in our compensation programs. As a regular part of its deliberations, the Compensation Committee considers how the structure of our compensation programs will affect risk-taking, and the extent to which those programs drive alignment with JLL’s long-term success and the interests of our shareholders. The Compensation Committee comments on this aspect of our compensation program under “How we make compensation decisions” on page 44.

The Nominating, Governance and Sustainability Committee monitors and discusses with management those risks that are inherent in our corporate governance and compliance programs. In the normal course of its activities, our Nominating, Governance and Sustainability Committee reviews emerging best practices in corporate governance and stays abreast of changes in laws and regulations that affect the way we manage the organization.

Ethical behavior and conduct are part of our culture, and more generally a part of who we are as an organization. JLL is committed to maintaining the highest ethical standards and engaging in practices that enhance the welfare, safety and well-being of our employees, business partners and wider communities across the world. The Board, and the Audit and Risk Committee, oversee the Company’s compliance with legal and regulatory requirements. The Audit and Risk Committee receives regular reports from the Company’s Chief Compliance Officer, who reports to the Company’s Chief Legal Officer, concerning compliance with the Company’s Code of Ethics and corporate securities trading policies including the status of significant investigations involving alleged violations of the Code of Ethics. Additionally, the Company’s Chief Legal Officer regularly reports to the Audit and Risk Committee on any legal matter that could have a potential significant impact on the Company’s financial statements, the Company’s compliance policies or any other financial disclosures.

The Audit and Risk Committee also receives regular reports from the Company’s Chief Audit Executive concerning the planned annual scope of the internal audit team and any significant reports to management prepared by the Company’s internal audit department and management’s responses. The Audit and Risk Committee advises the Board with respect to the Company’s policies and procedures regarding compliance with applicable laws and regulations and with the Company’s Code of Ethics.

In 2022, the Board approved an updated version of the Company’s Code of Ethics which sets forth the ethics principles that guide our operations globally and applies to all employees of JLL and the members of the Board. Our Code of Ethics includes a message from our Chairman of the Board and CEO, and emphasizes that ethics is in everything we do at JLL. Each year every member of the Board completes an attestation that he or she has reviewed the Code of Ethics and will comply with the principles set forth in the Code in carrying out his or her Board responsibilities.

| 2024 Proxy Statement | 30 |

The Board actively oversees our overall human capital management process, including diversity and inclusion, training and development, well-being, and health and safety. The Board also oversees the work of its Compensation Committee in developing corporate policies and frameworks designed to attract, retain, engage and develop a workforce that aligns with our values and organizational purpose. Since 2022, the Company has had a Global Head of Diversity, Equity, & Inclusion, who reports directly to the Company’s CEO. The Company’s Global Head of Diversity, Equity & Inclusion, together with the CHRO, provides regular updates to the Board on the Company’s DEI initiatives and progress against stated objectives.

Our Management and the Board of Directors provide significant oversight of risks from cybersecurity threats and are informed about and closely monitor the prevention, detection, mitigation and remediation of cybersecurity incidents. In May 2022, in furtherance of ensuring appropriate oversight of JLL’s cybersecurity and information technology readiness, the Board adopted an amended Charter of the Audit Committee that added cybersecurity and information technology readiness as part of the Committee’s purpose. In addition, the Audit Committee was renamed as the Audit and Risk Committee to more accurately align with its responsibility to assist the Board in overseeing the Company’s policies, programs and related risks identified as part of the enterprise risk management framework and cybersecurity and information technology. Cybersecurity is also reviewed as part of our overall enterprise risk management program, led by our Director of Enterprise Risk Management, which assesses our significant enterprise risks, provides a summary of those risks and primary mitigations, identifies control improvement projects for our significant risks, and regularly reports on the progress of control improvement projects for those risks to our GEB and the Audit & Risk Committee.

In the area of cybersecurity and information technology readiness, to respond to the threat of security breaches and cyberattacks, the Company has developed a cybersecurity program, the implementation of which is led by the Company’s Global Chief Information Officer (“CIO”) and the Chief Information Security Officer (“CISO”). Our cybersecurity program is designed to protect and preserve the confidentiality, integrity and continued availability of all information and systems owned by us, or in our care. Our cybersecurity program strategy is to implement layered controls to reduce our cybersecurity risk by minimizing both the likelihood and potential impact of cybersecurity events. These controls are aligned with the National Institute of Standards and Technology (NIST) cybersecurity framework. We maintain a robust cyber incident response plan that includes controls and procedures designed to allow timely and accurate reporting of any material cybersecurity incident. We view cybersecurity as a shared responsibility, and we periodically perform simulations and tabletop exercises at a management level and incorporate external resources as well. We provide at least annual information security training for employees who have access to Company or client-related sensitive or personal information and regularly conduct phishing tests and education. We continue to implement new controls, governance, technical protections and other procedures to mitigate against the risks of a cybersecurity event. We have experienced various types of cyber-attack incidents in the last three years, which to-date have been contained and have not been material to us. JLL also maintains a cyber risk insurance policy.

The Audit and Risk Committee receives regular reports from our CIO and CISO on the Company’s information security program including the Company’s top cybersecurity risks, cybersecurity strategy, information system controls and related security measures and improvements, cyber incident response plan, cybersecurity incidents and cyber defense metrics, and cyber security protocols and trainings. These regular reports also are shared with the full Board, which, in recognition of the increasing importance of cybersecurity in today’s digital landscape and the critical need for robust cybersecurity measures to protect the Company’s sensitive information, infrastructure, and assets, approved the establishment of a Cybersecurity Subcommittee of the Audit and Risk Committee in March 2024.

| 2024 Proxy Statement | 31 |

Shareholder engagement is a core JLL practice that is a significant part of our ongoing dialogue with our stakeholders to ensure that existing and potential investors understand our strategy, financial results, and future growth drivers. Engagement sessions allow investors to share their feedback so that we better understand their priorities.

| • | Industry trends and outlook |

| • | JLL global business strategy and performance |

| • | Human capital management and executive compensation |

| • | Sustainability, Social and Corporate Governance matters |

Our investor engagement initiatives occur year-round. During 2023, JLL provided institutional investors with a wide variety of opportunities to provide feedback through different channels including through our:

| • | Investor Outreach Program: More than 200 one-on-one investor meetings and calls, reaching holders of approximately 40% of our shares. |

| • | Meetings & conferences: Attended six industry conferences, hosted multiple investor headquarters visits, and participated in two sell-side sponsored industry days. |

| • | Corporate governance calls: The Chairman of our Board of Directors held meetings with five of JLL’s top shareholders to discuss Corporate Governance, Executive Compensation, and Sustainability. |

We partner with our stakeholders to drive innovative, impactful, sustainable change by embedding sustainability into everything we do. Sustainability facilitates our ability to deliver long-term value to our shareholders, create productive, healthy spaces for our clients and employees, and energize our communities.

We’ve already achieved much to be proud of, but our vision is to do more to embed sustainability across the whole business and deliver our purpose to shape the future of real estate for a better world.

| 2024 Proxy Statement | 32 |

Our purpose has deep roots in our identity and history, and is the guiding principle informing our sustainability program. We partner with our stakeholders to deliver sustainability through:

Key issue |  Climate action for sustainable real estate |  Healthy spaces for all people |  Inclusive places for thriving communities | |||||

Definition | We take urgent climate action that accelerates the transition to net zero, enhances performance, mitigates risks and helps shape a better world | We create safe and healthy spaces that promote productivity, wellbeing and sustainability | We provide fair and inclusive places that create positive social impact and equal opportunities |

Our market position enables us to take actions that contribute to a better world. In so doing, we demonstrate our responsibility as an organization, bring our purpose to life, add value to our brand, and use our position to attract and retain talent.

Sustainability matters to our clients for many of the same reasons it matters to us. They want to enhance the value of their real estate assets and drive operational efficiencies and cost savings. They also seek to attract and retain a productive, healthy and diverse workforce and achieve positive impacts in their communities. Like JLL, many of our clients have their own sustainability goals and are seeking partners who can help them achieve their objectives.

With JLL managing nearly 5 billion square feet of space globally for our clients — approximately 1100x the square footage that we ourselves occupy — our greatest opportunity for impact is with and through our clients.

Our expertise addresses the entire lifecycle of a building and human experience, from design and planning of buildings through to construction, occupation, management, refurbishment and exit. We offer advice on how sustainability considerations can be embedded at each of these stages to maximize value. JLL’s sustainability professionals provide market-leading solutions to make our buildings smart, healthy and productive. And through LaSalle, with its ESG best practices, we enhance the performance of our clients’ investments.

Refer to our annual ESG Report for more detailed information, including JLL’s commitment to net-zero carbon operations for our leased offices and updates on progress toward achieving our broader net-zero emissions target, which was validated by the Science Based Target initiative (SBTi) in 2021.

We value the continued interest of and feedback from our shareholders and other interested parties, and we are committed to maintaining our active dialogue with you. Shareholders and other interested parties may communicate directly with our Board of Directors by email or regular mail. If you wish to communicate only with our non-employee Directors, or with a particular Director individually, please so note in your communication.

|  | ||

| By email boardofdirectors@jll.com Corporate Secretary will forward to all Directors | By mail Jones Lang LaSalle Incorporated c/o Corporate Secretary 200 East Randolph Drive Chicago, Illinois 60601 Corporate Secretary will forward to the intended recipient(s) |

| 2024 Proxy Statement | 33 |

We have adopted aconflict of interest policy as part of JLL’s Code of Business Ethics, under which we expectsets forth our expectation that all Directors, Corporate Officers,executive officers and JLL employees of the Company towill make business decisions and take actions based upon JLL’s best interests and not based uponrather than personal relationships or benefits.

The Board has also adopted a formal written policy and procedures forrequiring the review and approval of any transaction, arrangement or relationship (or any series of similar transactions, arrangements, or relationships) (1) that involves a potential corporate opportunity or in which we were, are, or will be a participant, (2) where the amount involved exceeds $120,000, and (3) in which any of the following persons had, has or will have a direct or indirect material interest:

Based on the above criteria, we have described the reportable related party transactions with our beneficial owners of more than 5% of our Common Stock, Corporate Officers and Directors in 2015 under “Certain Relationships and Related Transactions” with respect (i) BlackRock, Inc., (ii) The Vanguard Group, and (iii) T. Rowe Price.

|

| |

| • | Any beneficial owner of more than 5% of any class of our voting securities; | |

| • | Any immediate family member of the foregoing persons; and | |

| • | Any entity in which any of the foregoing persons has a substantial ownership interest or control. |

Non-Executive Chairman of the Board; Lead Independent Director

Since January 1, 2005, Ms. Penrose, a Non-Executive Director, has held the role of theChairman of the Board. The Board has determined that Ms. Penrose will also serve as the Lead Independent Director of the Board for purposes of the NYSE’s corporate governance rules.

In her role as Chairman of the Board, Ms. Penrose’sduties include the following:

The Board considers theelection of a Chairman annually, immediately following each Annual Meeting of Shareholders. In May 2015, the Board extended the term of Ms. Penrose’s appointment to the date of the 2016 Annual Meeting of Shareholders, at which time the Board will re-evaluate whether to further extend her appointment.

The Board has determined that each person who serves as Chairman of the Board from time to time, if that person is independent, will automatically also serve as a member of each of the Board’s Committees, although not necessarily as its Chairman.

Our leadership structure separates our Chief Executive Officer and Chairman of the Board positions and makes the latter ourLead Independent Director. We believe this approach, which corporate governance experts generally view as the best practice, is useful and appropriate for a complex and global organization such as ours.

Director Orientation and Continuing Education

We provide Directors who join our Board with aninitial orientation about the Company, including our business operations, strategy, policies, code of ethics, sustainability, integrated reporting, and governance. We then provide all of our Directors withresources and on-going education opportunities to assist them in staying current about developments in corporate governance and critical issues relating to the operation of public company boards and their committees. We actively participate in various professional organizations, such as the NYSE Governance Council and the Business Ethics Leadership Alliance, that provide training opportunities and information about best practices in corporate governance and business ethics. Our Board also visits Company offices in different cities as part of its regularly scheduled Board meetings, and typically this includes sessions with management, staff and clients.

Annual Board Self-Assessments and Senior Management Assessments

Our Boardannually conducts a self-evaluation to determine whether it and its Committees are functioning effectively and how they might enhance their effectiveness. For years prior to 2014, the evaluations were conducted by surveying the Board members in writing (with anonymous responses submitted). As part of that process, (1) our Chairman of the Board also engaged in individual discussions with each Board member about his or her views and (2) the Chairman of our Compensation Committee solicited input from the Board members about the leadership by the Chairman of the Board. Additionally, our Board solicited input (also on an anonymous basis) from the members of senior management who regularly interacted with the Board in order to determine management’s view about how effectively the Board interacted with the Company and oversaw its

|

| |

strategies and execution. The Board members reviewed and discussed the responses to both of these surveys, and the Chairman provided senior management with responsive feedback.

For its 2014 self-assessment, the Board retained an independent third party to conduct confidential interviews of each Board member and certain members of senior management, and then discussed the results with the Board.

For its 2015 self-assessment, the Board reverted to the written survey approach. In the future, we anticipate that the Board will alternate between the written and the interview approaches.

Policy on Trading Stock; Policy Against Pledging or Hedging Stock

We have ainsider trading policy provides that all Directors, the Corporate Officers listed in this Proxy Statement,members of our GEB, selected senior leaders, and certain other designated individuals (1)members of their immediate families must pre-clear all trades in JLL stock with our General Counsel or Deputy General CounselChief Legal Officer, and (2)they, together with other designated employees, may not trade during designated“blackout “blackout periods” except (except under approved SEC Rule 10b5-1 trading plans.plans).

We also generally prohibitOur insider trading policy prohibits our Directors, employees, and Corporate Officerstheir immediate family members from engaging in short sales and transactions in derivatives of JLL stock, pledging JLL stock as collateral, and holding JLL stock in margin accounts. Our insider trading policy strongly discourages our Directors, employees, and their immediate family members from engaging in hedging or pledgingmonetization transactions involving our stock.

The full Board of Directors heldfour in-person meetings and six telephonic meeting during 2015. Each Director who held such position during 2015 attended, in aggregate, at least 75% of all meetings (including teleconferences) of the Board and of any Committee on which such Director served. Our Non-Executive Directors meet in executive session without management participation during every in-person Board meeting.

Our Board of Directors has a standingAudit Committee, Compensation Committee and Nominating and Governance Committee. The following table identifies:

| Director Name | Audit Committee | Compensation Committee | Nominating and Governance Committee |

| Hugo Bagué | — | ü | ü |

| Samuel A. Di Piazza, Jr. | — | ü | ü |

| Dame DeAnne Julius | ü | — | ü |

| Ming Lu | — | Chairman | ü |

| Martin H. Nesbitt | ü | — | ü |

| Sheila A. Penrose | ü | ü | Chairman |

| Ann Marie Petach | ü | — | ü |

| Shailesh Rao | — | ü | ü |

| David B. Rickard | Chairman | — | ü |

| Number of Meetings During 2015 (Including teleconferences): | 9 | 6 | 6 |

In order to get the benefit of their additional perspectives, we invite Non-Executive Directors who are not members of a given Committee to attend all meetings of each Committee, although they are not obligated to do so. We also provide them access to all Committee materials for their information.

|

| |

Messrs. Rickard (Chairman) and Nesbitt, Dame DeAnne and Ms. Penrose served as members of our Audit Committee during the entire year of 2015. Ms. Petach was appointed to the Audit Committee shortly after being elected to the Board of Directors at the 2015 Annual Meeting.

Under the terms of its Charter,the Audit Committee acts on behalf of the Board to monitor (1) the integrity of the Company’s financial statements, (2) the qualifications and independence of the Company’s independent registered public accounting firm, (3) the performance of the Company’s internal audit function and of its independent registered public accounting firm, and (4) compliance by the Company with certain legal and regulatory requirements. In fulfilling its responsibilities, the Audit Committee has the full authority of the Board to, among other things:

See also the report of the Audit Committee set forth in the section headed “Audit Committee Report.”

Our Board has determined that each of the members of our Audit Committee is “financially literate” and that at least one of the members has “accounting or related financial management expertise,” in each case as required by the NYSE. Our Board has also determined that at least one of the members of the Committee, Mr. Rickard, its Chairman, qualifies as an “audit committee financial expert” for purposes of the applicable SEC rule.

|

| |

Messrs. Lu (Chairman), Bagué and Rao, Dame DeAnne, and Ms. Penrose served as members of the Compensation Committee during the entire year of 2015. Mr. Di Piazza was appointed to the Compensation Committee shortly after being elected to the Board of Directors at the 2015 Annual Meeting.

Under the terms of its Charter,the Compensation Committee acts on behalf of the Board to formulate, evaluate and approve the compensation of the Company’s executive officers and to oversee all compensation programs involving the use of the Company’s Common Stock. In fulfilling its responsibilities, the Compensation Committee has the full authority of the Board to, among other things:

See also the report of the Compensation Committee set forth in the section headed “Compensation Committee Report.”any proposed transaction.

|

| |

Compensation Committee Interlocks and Insider Participation. There are